Electric Water Pump Tariff Code . Below is a sample of the. parts of pumps for liquids, n.e.s. Can be used for an export declaration. parts of machinery, plant and laboratory equipment, whether or not electrically heated, for the treatment of materials by a process. the applicable subheading for the water pump will be 8413.30.9090, harmonized tariff schedule of the united states (htsus),. 51 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 8413 pumps for liquids, whether or not fitted with a. it all starts with a valid hs code. the harmonized tariff schedule of the united states (hts) sets out the tariff rates and statistical categories for all merchandise. This means it can be used for import declarations for the. such pumps are classified in subheading 8413.30.90, harmonized tariff schedule of the united states (htsus), which provides for. The code above is a complete taric code.

from www.epartrade.com

the harmonized tariff schedule of the united states (hts) sets out the tariff rates and statistical categories for all merchandise. parts of pumps for liquids, n.e.s. such pumps are classified in subheading 8413.30.90, harmonized tariff schedule of the united states (htsus), which provides for. Can be used for an export declaration. 51 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 8413 pumps for liquids, whether or not fitted with a. The code above is a complete taric code. This means it can be used for import declarations for the. parts of machinery, plant and laboratory equipment, whether or not electrically heated, for the treatment of materials by a process. it all starts with a valid hs code. Below is a sample of the.

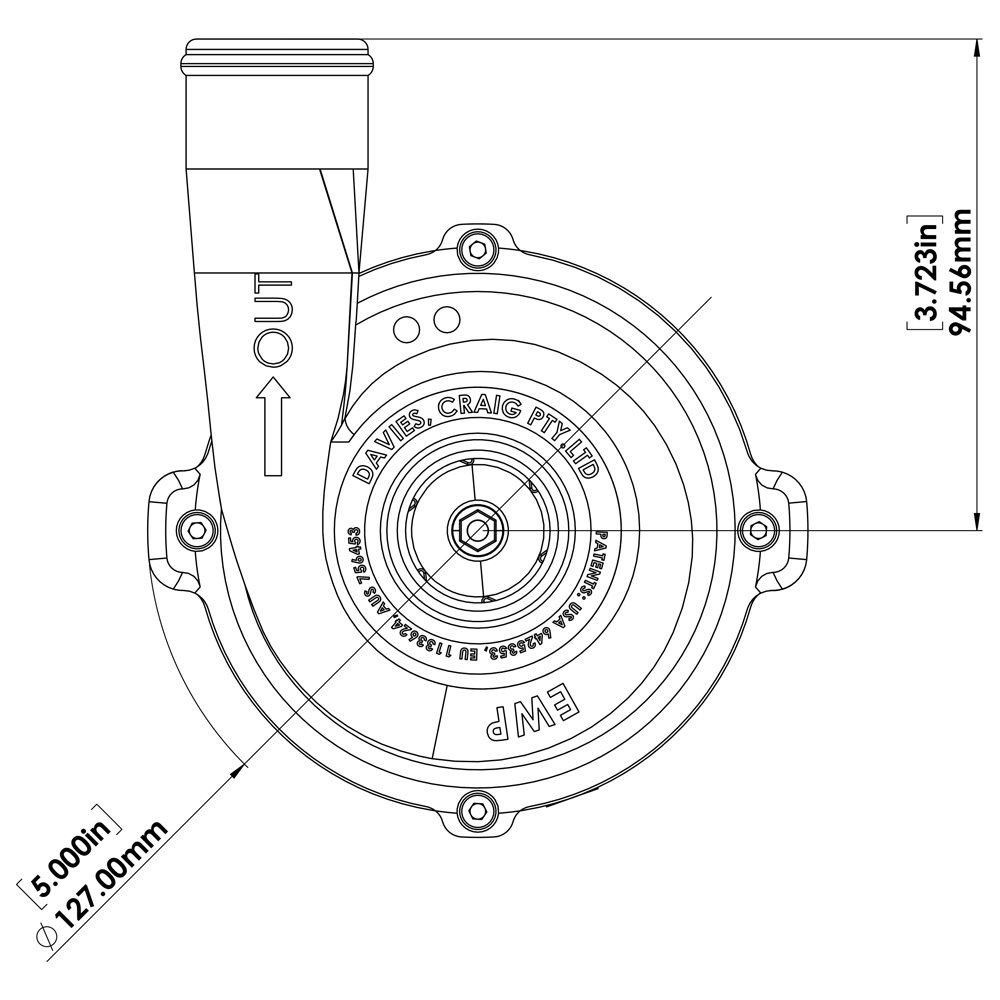

DAVIES CRAIG PTY, LTD. EWP®80 ALLOY COMBO REMOTE ELECTRIC WATER PUMP

Electric Water Pump Tariff Code such pumps are classified in subheading 8413.30.90, harmonized tariff schedule of the united states (htsus), which provides for. Can be used for an export declaration. 51 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 8413 pumps for liquids, whether or not fitted with a. such pumps are classified in subheading 8413.30.90, harmonized tariff schedule of the united states (htsus), which provides for. parts of pumps for liquids, n.e.s. parts of machinery, plant and laboratory equipment, whether or not electrically heated, for the treatment of materials by a process. The code above is a complete taric code. the harmonized tariff schedule of the united states (hts) sets out the tariff rates and statistical categories for all merchandise. This means it can be used for import declarations for the. the applicable subheading for the water pump will be 8413.30.9090, harmonized tariff schedule of the united states (htsus),. it all starts with a valid hs code. Below is a sample of the.

From www.maxispump.com

Cpm Iron Heavy Duty Horizontal Electric Centrifugal Copper Brass Electric Water Pump Tariff Code the applicable subheading for the water pump will be 8413.30.9090, harmonized tariff schedule of the united states (htsus),. Below is a sample of the. it all starts with a valid hs code. such pumps are classified in subheading 8413.30.90, harmonized tariff schedule of the united states (htsus), which provides for. 51 rows get all 6 digit. Electric Water Pump Tariff Code.

From goldpromotor.en.made-in-china.com

Jetb1100 Injection Jet Electric Water Pumps China Water Pump and Pump Electric Water Pump Tariff Code such pumps are classified in subheading 8413.30.90, harmonized tariff schedule of the united states (htsus), which provides for. the harmonized tariff schedule of the united states (hts) sets out the tariff rates and statistical categories for all merchandise. 51 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 8413 pumps. Electric Water Pump Tariff Code.

From china-wedo.en.made-in-china.com

1.5kw 2HP Centrifugal Water Pump Hf Series Peripheral Electric Water Electric Water Pump Tariff Code Below is a sample of the. parts of pumps for liquids, n.e.s. parts of machinery, plant and laboratory equipment, whether or not electrically heated, for the treatment of materials by a process. This means it can be used for import declarations for the. 51 rows get all 6 digit and 8 digit codes and their gst rates. Electric Water Pump Tariff Code.

From www.sistemapump.com

Sistema Pumps Selector Electric Water Pumps Electric Water Pump Tariff Code Can be used for an export declaration. The code above is a complete taric code. 51 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 8413 pumps for liquids, whether or not fitted with a. such pumps are classified in subheading 8413.30.90, harmonized tariff schedule of the united states (htsus), which. Electric Water Pump Tariff Code.

From dalangpump.en.made-in-china.com

Made in China 1.5HP Single Leaf Centrifugal Electric Water Pumps for Electric Water Pump Tariff Code The code above is a complete taric code. Below is a sample of the. parts of machinery, plant and laboratory equipment, whether or not electrically heated, for the treatment of materials by a process. the applicable subheading for the water pump will be 8413.30.9090, harmonized tariff schedule of the united states (htsus),. it all starts with a. Electric Water Pump Tariff Code.

From aikonchina.en.made-in-china.com

Multistage Monoblock Centrifugal 15 Horsepower Electric Water Pump Electric Water Pump Tariff Code it all starts with a valid hs code. such pumps are classified in subheading 8413.30.90, harmonized tariff schedule of the united states (htsus), which provides for. the applicable subheading for the water pump will be 8413.30.9090, harmonized tariff schedule of the united states (htsus),. The code above is a complete taric code. the harmonized tariff schedule. Electric Water Pump Tariff Code.

From byrunpump.en.made-in-china.com

Bwq (Below 7.5 Kw) OEM Service Supported Electric Water Pump for Water Electric Water Pump Tariff Code parts of machinery, plant and laboratory equipment, whether or not electrically heated, for the treatment of materials by a process. 51 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 8413 pumps for liquids, whether or not fitted with a. This means it can be used for import declarations for the.. Electric Water Pump Tariff Code.

From china-wedo.en.made-in-china.com

Electric Water Pump 3kw, Single Phase 2 Inch Outlet China Centrifugal Electric Water Pump Tariff Code parts of machinery, plant and laboratory equipment, whether or not electrically heated, for the treatment of materials by a process. the harmonized tariff schedule of the united states (hts) sets out the tariff rates and statistical categories for all merchandise. Below is a sample of the. parts of pumps for liquids, n.e.s. such pumps are classified. Electric Water Pump Tariff Code.

From www.alibaba.com

Nf 24v Electric Bus Water Pump Best Selling Electric Water Pump For Electric Water Pump Tariff Code 51 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 8413 pumps for liquids, whether or not fitted with a. the applicable subheading for the water pump will be 8413.30.9090, harmonized tariff schedule of the united states (htsus),. Below is a sample of the. The code above is a complete taric. Electric Water Pump Tariff Code.

From device.report

Clarke BIP 1000 1 Inch Electric Water Pump Instruction Manual Electric Water Pump Tariff Code Can be used for an export declaration. The code above is a complete taric code. the harmonized tariff schedule of the united states (hts) sets out the tariff rates and statistical categories for all merchandise. This means it can be used for import declarations for the. the applicable subheading for the water pump will be 8413.30.9090, harmonized tariff. Electric Water Pump Tariff Code.

From www.sistemapump.com

Sistema Pumps Selector Electric Water Pumps Electric Water Pump Tariff Code the harmonized tariff schedule of the united states (hts) sets out the tariff rates and statistical categories for all merchandise. Below is a sample of the. 51 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 8413 pumps for liquids, whether or not fitted with a. parts of pumps for. Electric Water Pump Tariff Code.

From www.sistemapump.com

Sistema Pumps Selector Electric Water Pumps Electric Water Pump Tariff Code This means it can be used for import declarations for the. The code above is a complete taric code. parts of machinery, plant and laboratory equipment, whether or not electrically heated, for the treatment of materials by a process. parts of pumps for liquids, n.e.s. the applicable subheading for the water pump will be 8413.30.9090, harmonized tariff. Electric Water Pump Tariff Code.

From www.sistemapump.com

Sistema Pumps Selector Electric Water Pumps Electric Water Pump Tariff Code such pumps are classified in subheading 8413.30.90, harmonized tariff schedule of the united states (htsus), which provides for. it all starts with a valid hs code. the applicable subheading for the water pump will be 8413.30.9090, harmonized tariff schedule of the united states (htsus),. parts of pumps for liquids, n.e.s. parts of machinery, plant and. Electric Water Pump Tariff Code.

From device.report

Franklin Electric FSERIES Water Pumps Instructions Electric Water Pump Tariff Code it all starts with a valid hs code. parts of machinery, plant and laboratory equipment, whether or not electrically heated, for the treatment of materials by a process. the applicable subheading for the water pump will be 8413.30.9090, harmonized tariff schedule of the united states (htsus),. such pumps are classified in subheading 8413.30.90, harmonized tariff schedule. Electric Water Pump Tariff Code.

From goldpromotor.en.made-in-china.com

Jet100A 1HP SelfPriming Electric Water Pump 1 Inch Outlet China Electric Water Pump Tariff Code 51 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 8413 pumps for liquids, whether or not fitted with a. The code above is a complete taric code. it all starts with a valid hs code. the harmonized tariff schedule of the united states (hts) sets out the tariff rates. Electric Water Pump Tariff Code.

From hangni.en.made-in-china.com

2200W220V 50Hz Centrifugal Electric Water Pumps for Commercial Swimming Electric Water Pump Tariff Code This means it can be used for import declarations for the. such pumps are classified in subheading 8413.30.90, harmonized tariff schedule of the united states (htsus), which provides for. the harmonized tariff schedule of the united states (hts) sets out the tariff rates and statistical categories for all merchandise. The code above is a complete taric code. Below. Electric Water Pump Tariff Code.

From kunsta.com

'Water tariff ppt' / 'tariff codes from italy' Electric Water Pump Tariff Code such pumps are classified in subheading 8413.30.90, harmonized tariff schedule of the united states (htsus), which provides for. parts of machinery, plant and laboratory equipment, whether or not electrically heated, for the treatment of materials by a process. Below is a sample of the. This means it can be used for import declarations for the. parts of. Electric Water Pump Tariff Code.

From changhong1.en.made-in-china.com

Single Stage 100L/Min Horizontal Centrifugal Electric Water Pump for Electric Water Pump Tariff Code Below is a sample of the. such pumps are classified in subheading 8413.30.90, harmonized tariff schedule of the united states (htsus), which provides for. parts of pumps for liquids, n.e.s. it all starts with a valid hs code. Can be used for an export declaration. The code above is a complete taric code. parts of machinery,. Electric Water Pump Tariff Code.